|

Re: How much money needed to Retire?

I tried to accumulate as much as possible.

Hopefully my prediction for 10 mil is true. |

Re: How much money needed to Retire?

Work until die, no need retire :D

|

Re: How much money needed to Retire?

Well this depends what retirement lifestyle you want..

|

Re: How much money needed to Retire?

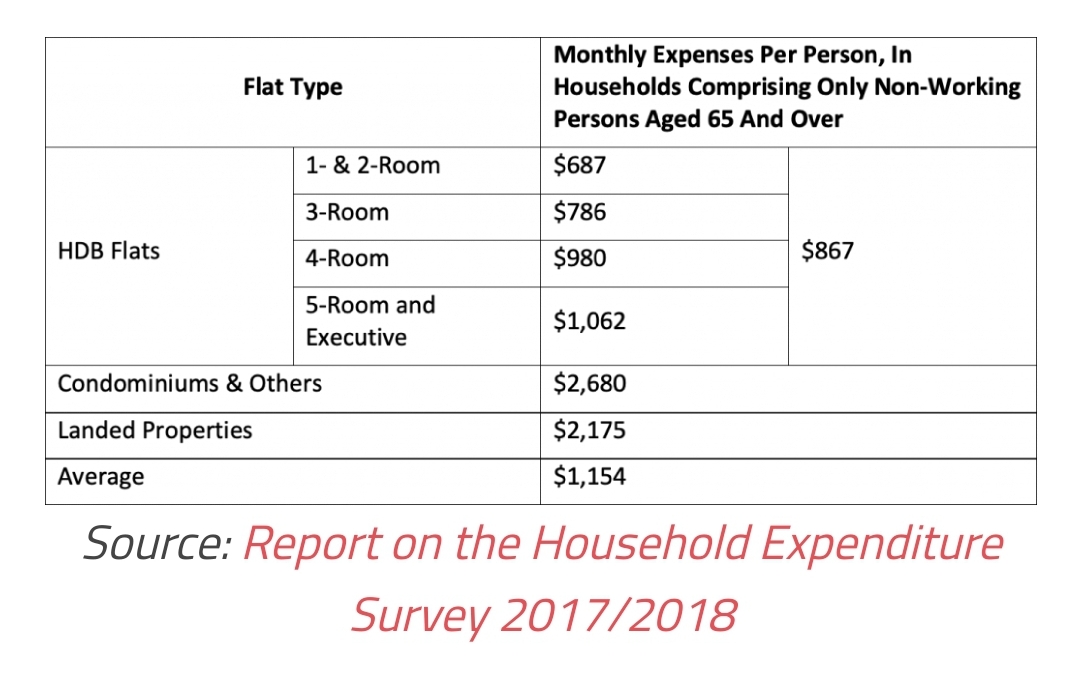

Found something interesting. A national survey was done in 2017 on the monthly expenses of a retired person aged 65 and above in Singapore.

The average "real life" retired singaporean uses only $1,154 a month! All the myths about needing more money in our retired years.... debunked! https://dollarsandsense.sg/heres-muc...ngapore-today/ |

Re: How much money needed to Retire?

Quote:

you have worked your whole life and when u retire u want to live a life of a dishwasher? With $1000, you could only eat mix veg rice everyday for the rest of your life + pay health insurance, electricity, phone bills, internet and basic household amenities. that leaves u less than $200/ month for transport to meet friends for coffee, movie or restaurant food those that drink beer, good luck! Then no $$ to go holiday once in a while? well maybe can go JB once a month but forget Bangkok Retirement should be time you enjoy the fruits of your labour, you should have at least 70% of your salary as retirement expenditure monthly. |

Re: How much money needed to Retire?

Quote:

This is the actual data of retired singaporeans. Maybe u don't understand the term "statistics"? Most retirees I know like to stay at home all the time i.e eat home cooked food. Old folks no energy go out. You show me a 75 y.o chiong jb/bangkok every month, i show you a liar. |

Re: How much money needed to Retire?

Single elderly households in Singapore need S$1,379 a month for basic needs: study

WED, MAY 22, 2019 - 5:15 PM RACHEL [email protected]@RachelMuiBT A SINGLE elderly person aged 65 and above, who lived alone in Singapore last year without a chronic illness required S$1,379 a month to meet basic needs. This is according to a study by the Lee Kuan Yew School of Public Policy, National University of Singapore (LKYSPP), released on Wednesday. The team of researchers, led by assistant professor Ng Kok Hoe from the LKYSPP, conducted focus group discussions involving over 100 participants from various backgrounds. Using a consensus-based methodology known as Minimum Income Standards (MIS), the groups came to agreement on how ordinary Singaporeans think about basic needs, and determined the household budgets necessary for older people to meet those needs. Participants generated lists of items and services related to housing and utilities, things needed in a two-room HDB flat, personal care items and clothing, food, transport, leisure and cultural activities, as well as healthcare. Each item or service was included only if participants came to a consensus that it was a basic need, and could explain their reasons for its inclusion. Based on the lists of items and services, the household budgets necessary to meet basic needs were: S$1,379 per month for single elderly households, S$2,351 per month for coupled elderly households, and S$1,721 per month for single persons aged 55-64, the study showed. Said Dr Ng: "This study reveals that ordinary members of society can come to a consensus about a basic standard of living in light of norms and experiences in contemporary Singapore. Such income standards can help by translating societal values and real experiences into unambiguous and substantive benchmarks that policy can aim for." Generally, participants agreed that basic needs must go beyond subsistence to include one's quality of life. They also emphasised the importance of independence and autonomy, which means not being a burden to loved ones, and being able to exercise one's choice and preferences. "A basic standard of living in Singapore is about, but more than just, housing, food and clothing. It is about having opportunities to education, employment and work-life balance, as well as access to healthcare," the report stated. "This study reveals that ordinary members of society are able to come to consensus about what a basic standard of living in contemporary Singapore means. What they said about dignity, respect, social belonging and choice, as well as the items and budget they came up with, reveal norms and values held by people in our society today." In the focus group discussions, participants also highlighted frequently that health and healthcare costs are very important to them. Nonetheless, the researchers noted that such costs may vary widely for different health conditions, and are difficult to capture accurately in a single study. Therefore, the study focused on establishing a baseline that presumes no chronic health conditions, with the researchers noting that this presumption likely underestimates healthcare costs. "Future research can build on this study by comparing the individual budgets for healthy persons with that of persons with particular health conditions and additional needs," they said. Comparing the household budgets against work incomes, the study highlighted that the median monthly work income of full-time workers aged 60 and above was S$2,000 back in 2017. This is about 1.5 times the budget for meeting basic standards of living among single elderly households. However, the researchers also pointed out that there are gender differences, with the median earnings of elderly women coming closer to the budget at just 1.3 times, compared to the 1.5 times for men. Moreover, the report suggested that the overall picture in Singapore is one of heavy dependence on family contributions, with limited support from the state. In particular, the most common income source is adult children (78 per cent of elderly people reported such income in 2011), followed by wage work (21 per cent), and the CPF or other annuities (13 per cent). This raises a few policy concerns, the researchers said. "Due to rapid socio-economic development, current cohorts of older people have steep educational and skill disadvantages compared to younger workers. When work incomes and wage interventions fall short, some older people either do not have the means to ever retire or will be permanently dependent on public and informal transfers. "Even among younger cohorts, lifetime wages can and do vary. With the widening of income inequality in Singapore over the past decades, people will become older with varying levels of savings." They added that while CPF participation and savings are projected to increase with future cohorts, the basic retirement payment of less than S$800, even after the most recent reforms, is only about half of the household budget for a single elderly person, and falls significantly short of what is required for a basic standard of living. Added associate professor Teo You Yenn from the School of Social Sciences at Nanyang Technological University (NTU), another member of the research team and author of the book "This Is What Inequality Looks Like": "To tackle inequality, it is critical to establish an agreed floor below which no one should fall. The MIS method can be usefully applied to generate societal consensus across a range of household types." The study pointed out that currently, major public transfer schemes are means-tested and modest, with most subsidies being one-off for a limited period, or for limited cohorts. As such, access is not assured, the researchers explained. Furthermore, cross-generational family support is demographically unsustainable as the family size shrinks. This means that people will have either no, or fewer children as sources of retirement income, the researchers noted. "The reliance on adult children as sources of retirement income may moreover reinforce economic inequality insofar as supporting parents takes up a greater proportion of household costs for the lower and middle-income compared to theirhigher-income counterparts. This leaves less for other needs of younger households, such as children’s education." Therefore, the researchers noted that overall, the gaps in people's capacity to meet basic standards of living must be urgently addressed so that older people in Singapore can achieve what the survey participants described as basic needs for "a sense of belonging, respect, security, and independence". |

Re: How much money needed to Retire?

I shared this article on the first page. Yes, LKY School of Public Policy researchers concluded a single person needs $1,379.

The Household survey conducted every 5 years show the "actual" spending of a typical singaporean across different housing types. 2 room hdb - $687 Condo - $2,680 I find the 2 sets of data congruent |

Re: How much money needed to Retire?

Quote:

But he and his wife, my MIL, hardly spend. Expenditure $2k+. Not even $3k a month ($1.5k per pax). Its not no money. Its just their lifestyle. Ps: and no, he doesnt meet friends for coffee, movie or restaurant food. Maybe max once a year. Not anti social. Like i said, its just their lifestyle |

Re: How much money needed to Retire?

With the fucking whites in charge, don't even think of retirement

|

Re: How much money needed to Retire?

at least 1 million cash and 2 property that are rented out. once retired, will not have any active income, thus, there must have at least a passive income

|

Re: How much money needed to Retire?

Quote:

|

Re: How much money needed to Retire?

Quote:

|

Re: How much money needed to Retire?

Quote:

with $1.5 million, u can retire at age 50 like me and start enjoying life while u are not too old and your capital is still intact (u are spending on returns) but CPFlife, u deplete the capital The choice is yours.. |

Re: How much money needed to Retire?

Quote:

Actually, the financial capability is the same. Yes, when one purchases an annuity like CPF Life, the principal is gone. He gets a fixed payout. In your case, you can't touch your principal too. Else the payout drops. So financially, you just spend the returns on principal. 3% of $1.5m = $3.8k. Not much different from a couple getting $4k for life from CPF Life. (This is a very good point. I will elaborate in my next post) But its good to have $1.5m as buffer for emergencies. Nah, I don't have a choice. I have kids. $3.8k a month can't feed them. |

| All times are GMT +8. The time now is 09:05 PM. |

Powered by vBulletin® Version 3.8.10

Copyright ©2000 - 2024, vBulletin Solutions, Inc.

User Alert System provided by

Advanced User Tagging (Pro) -

vBulletin Mods & Addons Copyright © 2024 DragonByte Technologies Ltd.

Copywrong © Samuel Leong 2006 ~ 2023